When you’re on Medicare, a U.S. federal health insurance program for people 65 and older, and some younger people with disabilities. Also known as Original Medicare, it helps cover hospital stays, doctor visits, and—importantly—prescription drugs through Part D. But knowing how to get the most out of it, especially for generic medications, lower-cost versions of brand-name drugs that contain the same active ingredients and meet FDA standards. Also known as generic drugs, they’re often 80% cheaper than name brands. isn’t always obvious. Many people pay more than they need to because they don’t understand how formularies work, or they skip checking if their pharmacy offers better prices. The truth? Medicare generic help isn’t about luck—it’s about knowing where to look and what questions to ask.

One of the biggest mistakes people make is assuming their plan’s preferred pharmacy is the cheapest. Not true. Some pharmacies charge way more for the same generic pill just because they’re in-network. Others run weekly discounts you won’t find online. Then there’s the Medicare Part D, the prescription drug coverage component of Medicare that’s offered by private insurance companies approved by Medicare. Also known as Medicare drug plans, it’s where the real savings happen—if you pick the right one. Plans change every year. A drug that was cheap last year might be in a higher tier this year. And if you take multiple meds, your total out-of-pocket cost can spike fast. That’s why comparing plans isn’t optional—it’s essential. Tools like the Medicare Plan Finder exist, but most people don’t use them right. They filter by price alone. You need to check copays, deductibles, and whether your exact brand of generic is covered. Some plans cover generic lisinopril but not the version your doctor prescribed. That’s a trap.

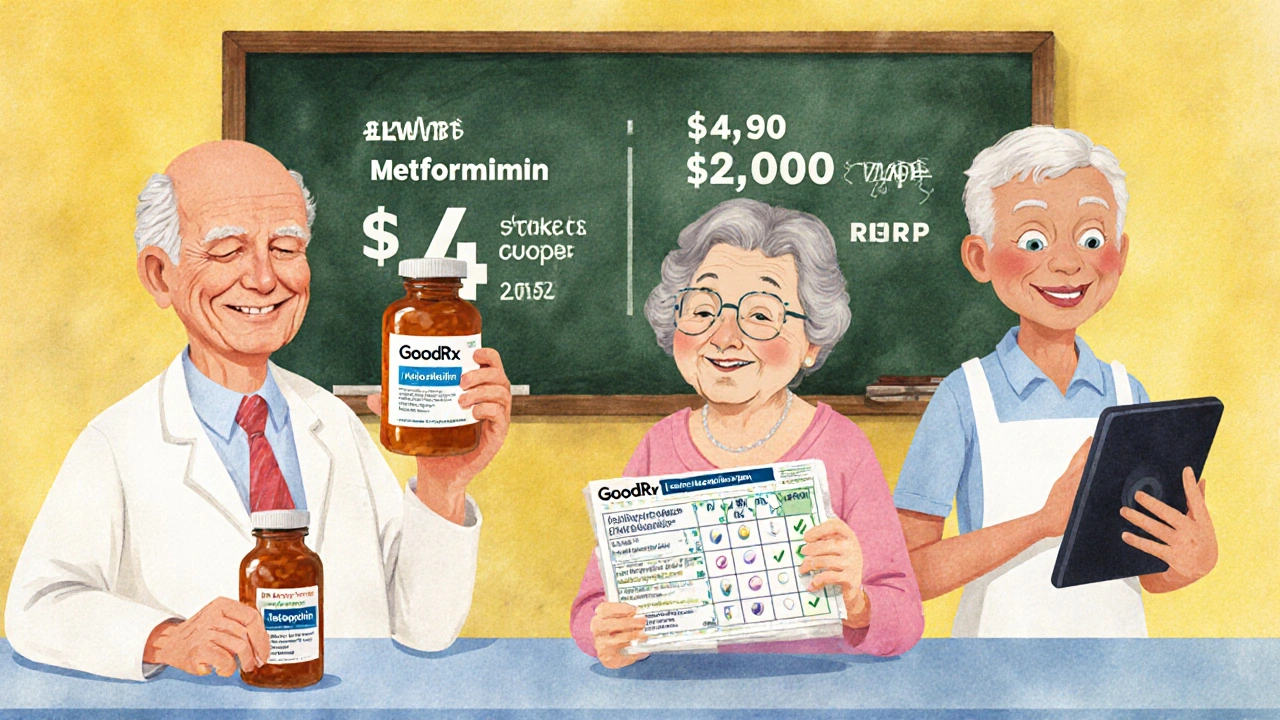

And don’t forget about manufacturer coupons, mail-order options, and pharmacy discount cards like GoodRx. Even if you’re on Medicare, you can still use these to lower your cost. Some people think they can’t combine them with Part D, but that’s a myth. You can use a coupon before your deductible is met, then switch to your plan later. It’s legal, it’s smart, and it saves hundreds a year. The key is tracking your spending and knowing your plan’s coverage phases—initial coverage, deductible, coverage gap, catastrophic. Each one changes how much you pay. If you’re taking high-cost generics like metformin, atorvastatin, or levothyroxine, even a small copay difference adds up fast.

What you’ll find below is a collection of real, practical guides on medications people actually take—clozapine, diclofenac, sildenafil, indapamide, and more. These aren’t just drug reviews. They’re deep dives into how these meds interact with your body, what alternatives exist, how to spot side effects early, and how to save money without risking your health. Whether you’re trying to cut costs on your monthly prescriptions or just want to understand why your generic isn’t working like it used to, the answers are here. No fluff. No upsells. Just clear, honest info to help you take control of your meds—and your money.

Posted by

Jenny Garner

13 Comments

Learn how to cut costs on generic prescription drugs with Medicare Extra Help, pharmacy discount programs, and nonprofit aid. Discover why generics still cost too much and what’s changing in 2025.

read more